Quantum Sensing Market Overview

Harvey Morrison: Co-Founder/CEO, Marion Square

Defining the Field

In this research, quantum sensing refers to sensing and measurement systems that exploit quantum scale effects to deliver material improvements in precision, stability, or resilience, particularly for positioning, navigation, and timing (PNT) and situational awareness in environments where conventional sensors degrade or fail. The focus is on field relevant systems and subsystems including quantum enhanced inertial sensing, gravimetry, magnetometry, and timing or oscillator approaches used for navigation and sensing.

Who Is Funding the Market Today

Near term spending in quantum sensing is led by U.S. Government research, test, and transition organizations, where funding is available to validate operational advantage and retire integration risk ahead of broader adoption. Within the defense community, organizations such as DARPA, AFRL, ONR, and Army Futures Command play a central role by sponsoring experimentation, field trials, and early transition efforts tied to specific mission needs, including assured PNT, autonomy, and sensing resilience in contested environments. Parallel activity exists across other federal missions where assured sensing and timing are critical; however, the dominant early market-making behavior remains government led validation.

Current State of Market Maturity

Quantum sensing is post feasibility but pre-scale. The market is moving from RDT&E into transition activity, characterized by operationally relevant testing, platform integration pilots, and limited early procurements rather than broad programs of record. Progress toward production is gated less by performance claims than by repeatability in operational environments, SWaP-C (Size, Weight, Power, and Cost) and environmental qualification, integration burden (hardware and software), and a credible sustainment path. As a result, the near-term market is defined by funded validation and transition efforts that precede wider production adoption. Platform manufacturers including UAV and UUV OEMs typically engage as downstream adopters once government-funded programs have materially reduced integration and performance risk.

Why quantum sensing is being funded- Mission Drivers and Priority Use Cases

Quantum sensing is being funded because modern military and security operations are colliding with physical and electromagnetic limits that legacy sensors cannot overcome. The problem is not that current systems are poorly engineered it is that the operational environment has changed.

Modern conflicts and large-scale exercises have demonstrated that GNSS (Global Navigation Satellite System) is now a contested resource. Jamming, spoofing, and denial are no longer rare disruptions but persistent operating conditions. At the same time, U.S. and allied forces are increasingly dependent on autonomous and semi-autonomous platforms that cannot rely on continuous communications or external updates to function.

This creates a structural vulnerability: many platforms still depend on satellite based or externally referenced navigation and timing, even though those references cannot be guaranteed.

As a result, government investment has expanded beyond incremental hardening of GNSS-dependent systems to include sensing approaches designed to maintain navigation continuity and situational awareness during extended periods without external references. Quantum sensing is being evaluated as part of this shift not as a wholesale replacement for existing sensors, but as a way to extend performance where conventional approaches degrade fastest.

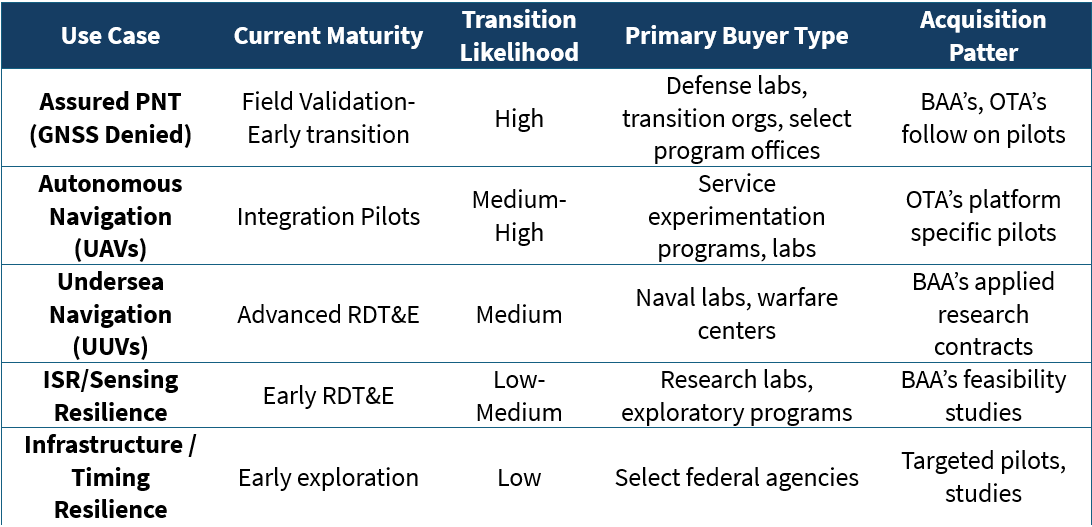

Priority Use Cases Shaping Near Term Demand- Assured PNT in GNSS-Denied Environments

The most mature and strategically important use case for quantum sensing is assured positioning, navigation, and timing (PNT) in environments where GNSS is denied, degraded, or unreliable.

Existing mitigations inertial navigation systems, terrain-based navigation, and RF-assisted methods provide partial resilience but suffer from cumulative drift, environmental dependence, or susceptibility to interference. Over long durations or in highly contested environments, these errors compound and directly degrade mission effectiveness.

Quantum enhanced inertial sensing and timing technologies are being evaluated for their ability to slow error growth and stabilize navigation without external updates, allowing platforms to maintain usable navigation and timing even when cut off from satellites and communications.

This makes assured PNT the clearest operational anchor for near-term quantum sensing investment.

Autonomous Navigation for UAVs

Uncrewed aerial systems are increasingly expected to operate in contested, disconnected, and distributed environments. As autonomy becomes more central to air operations, the ability to navigate accurately without GNSS or continuous command and control becomes a gating requirement.

Quantum sensing is being explored as a way to improve navigation stability and robustness for these platforms, particularly for long-endurance missions and operations beyond line-of-sight. In practice, quantum-enabled sensors are evaluated as part of a broader navigation stack rather than as standalone solutions.

The operational need is clear: autonomy without reliable navigation is not autonomy at all.

Undersea Navigation and Awareness (UUVs)

The undersea domain is inherently GNSS-denied and communications-limited. Uncrewed undersea vehicles must navigate for extended periods without external references, and navigation error directly affects mission outcomes such as mapping, sensing, and payload delivery.

Quantum sensing is being explored for its potential to improve long-duration navigation stability and situational awareness in this environment. Compared to air platforms, undersea integration is more technically demanding, but the strategic importance of undersea operations creates sustained pull for improved navigation and sensing performance.

ISR and Sensing Resilience

Beyond navigation, quantum sensing is also being explored for its ability to improve measurement sensitivity and stability in contested electromagnetic environments, supporting intelligence, surveillance, and reconnaissance missions.

In these applications, quantum approaches are evaluated as enhancements to existing sensing stacks rather than replacements. The goal is to maintain usable sensing performance where clutter, interference, or adversary countermeasures degrade conventional systems.

These applications remain earlier in maturity than navigation-focused use cases.

Which Use Cases Will Transition First

Use cases tied directly to navigation continuity especially assured PNT and autonomous navigation show the strongest near-term pull. These problems are well-defined, operationally critical, and testable in realistic environments.

Undersea applications follow, driven by strategic importance but constrained by integration complexity. ISR-oriented applications face the longest timelines due to system-level complexity and the need for clear operational differentiation.

Buyer Landscape and Acquisition Pathways- Who turns mission need into contracts

Quantum sensing is not being adopted first by platform program offices or commercial buyers. It is being pulled into the market by government organizations whose role is to validate, integrate, and de-risk new capabilities before they are ready for large-scale adoption.

These organizations act as market makers. They create the bridge between mission need and procurement reality.

Who Buys Quantum Sensing Today

Three buyer classes dominate the near-term market:

1. Research and Applied Laboratories

Organizations such as DARPA, AFRL, ONR, and Army Futures Command fund early-stage and applied programs to determine whether quantum sensing can deliver operational advantage under realistic conditions.

These buyers are willing to fund technical risk. Their objective is not production, but to determine what is feasible, what is repeatable, and what might be worth transitioning.

2. Transition and Experimentation Organizations

These groups fund field trials, integration pilots, and limited operational demonstrations. Their job is to take promising laboratory results and test whether they can survive contact with real platforms, operators, and environments.

They focus on:

integration burden

environmental qualification

reliability and maintainability

operational usefulness

This is where quantum sensing moves from “interesting” to “deployable.”

3. Program Offices and Platform Owners

Program offices and OEMs typically engage only after technical and integration risk has been materially reduced. Their focus is on:

reliability

sustainment

cost

compatibility with existing platforms

They are rarely first movers in this market. Instead, they follow once government funded transition programs have validated that a technology can be integrated and supported.

How Quantum Sensing Is Funded

Because the market is in transition rather than production, funding flows through mechanisms designed for experimentation and prototyping rather than large procurement programs:

Broad Agency Announcements (BAAs) for applied and exploratory work

Other Transaction Authorities (OTAs) for prototypes, pilots, and follow-on awards

Service-specific experimentation programs focused on autonomy, PNT resilience, and undersea operations

Vendors typically encounter multiple small to mid-scale awards across several organizations, rather than a single large contract. Transition success depends on:

performance in operational environments

ease of integration

availability of a committed transition partner

What This Means for the Market

In the near term, quantum sensing is a transition driven market, not a procurement-driven one. Revenue is generated through:

experimentation

field testing

platform pilots

limited early operational use

Scale comes later after risk has been retired and program offices are willing to adopt.

FY26 Funding Reality and Market Scale

Quantum sensing is not a speculative future market. It is being pulled into existence by active FY26 government funding tied to navigation resilience, autonomy, and sensing under contested conditions. While quantum sensing does not yet appear as a standalone budget line, it sits squarely inside several of the U.S. Government’s highest-priority RDT&E portfolios.

Understanding where this funding lives is critical to understanding how the market will develop.

The FY26 Government Funding Stack

In FY26, quantum sensing is funded through three overlapping layers of government spending:

1) Direct PNT and Navigation Resilience Budgets

These are programs explicitly created to solve GNSS denial and timing vulnerability.

The clearest example is the U.S. Air Force’s PNT Resiliency, Modifications, and Improvements program, which carries $125.7 million in FY26 to modernize navigation, timing, and alternate PNT across Air Force and joint systems.

This is not research for its own sake it is operational funding aimed at fielding GNSS-denied navigation and timing. Quantum inertial sensors, clocks, and navigation-grade sensing technologies directly compete for this money.

2) DARPA’s Advanced Technology Development Portfolio

In FY26, DARPA consolidated its advanced sensing, timing, navigation, and hardware development efforts into a single umbrella portfolio: DARPA Advanced Technology Development (PE 0603467E), funded at approximately $1.7 billion in FY26.

This portfolio includes:

advanced sensors

clocks and timing

navigation technologies

autonomy-enabling hardware

ISR and multi-domain awareness technologies

Quantum sensing programs are funded inside this portfolio as specific projects, alongside other high-risk, high-payoff technologies. While the full $1.7B is not quantum-specific, this is the primary DARPA engine through which quantum sensing concepts are validated, matured, and prepared for transition.

For market sizing purposes, this portfolio defines the upper bound of DARPA driven opportunity for quantum sensing in FY26 and beyond.

3) Service RDT&E Portfolios that Drive Transition

Beyond DARPA and the Air Force PNT line, each military service maintains RDT&E portfolios that fund:

undersea navigation and sensing

autonomous system navigation stacks

ISR and sensor resilience

environment-aware sensing

For example, the Navy’s Office of Naval Research (ONR) and undersea warfare centers fund navigation and sensing science through portfolios such as Defense Research Sciences and Ocean Warfighting Environment, while the Army funds navigation, sensors, and timing through its Information Sciences and Soldier Sensor programs.

These portfolios do not exist solely to fund quantum technology but they represent the mission-driven pull for better navigation, timing, and sensing that quantum systems are designed to address.

How This Translates Into a Real Market

The FY26 funding structure creates a two stage market:

Stage 1 — Funded Validation and Transition

Quantum sensing companies compete today for:

PNT resilience funding

DARPA advanced development projects

service laboratory RDT&E

platform integration pilots

This stage produces:

prototypes

field trials

early operational use

the data needed for programs of record

This is a multi-hundred million dollar cumulative market across DoD, spread across dozens of programs rather than a single mega-contract.

Stage 2 — Platform Adoption

Once risk is retired, quantum sensors migrate into:

UAV and UUV navigation systems

missile guidance systems

ISR platforms

resilient timing infrastructure

This is where the market scales, because sensors become line items inside large platform programs. The Navy’s undersea fleet, the Air Force’s autonomous aircraft, and DoD’s missile and ISR systems create a multi-billion-dollar attach surface for quantum-grade navigation and sensing once validated.

Why FY26 Matters

FY26 is a pivotal year because:

GNSS denial is now a budgeted reality, not a hypothetical

Autonomy and uncrewed systems are scaling across DoD

DARPA and the services are funding transition-ready sensing and navigation, not just lab science

This is the point at which quantum sensing moves from physics to procurement.

For vendors, the implication is clear:

The near term market is defined by funded transition programs, while the long-term market is defined by platform adoption. Both are now visible in the FY26 budget.

What This Means for Quantum Sensing Companies

Quantum sensing companies are no longer selling into a speculative market. They are selling into a defined government transition pipeline driven by GNSS denial, autonomy, and contested-domain operations. The FY26 budget confirms that this pipeline is real, funded, and expanding.

But success in this market will not come from generic “quantum” positioning. It will come from understanding how the government actually buys and transitions sensing technologies.

1. Your real buyers are not primes they are transition organizations

In the near term, quantum sensing companies should focus on:

DARPA

AFRL

ONR and Navy warfare centers

Service experimentation and transition organizations

DIU, AFWERX, and similar channels

These organizations control the budgets that fund:

prototypes

field trials

platform integration

early operational use

OEMs and primes will follow but only after these organizations have retired performance and integration risk.

2. Your products must map to funded mission problems

The FY26 funding environment is anchored around a small number of mission drivers:

GNSS-denied PNT

autonomous navigation

undersea navigation and awareness

sensing resilience in contested environments

Quantum sensing companies that cannot clearly map their technology to one of these funded mission problems will struggle to get traction regardless of how impressive the physics may be.

3. Integration matters more than performance claims

The government is no longer asking whether quantum sensors work in the lab. It is asking:

Do they survive operational environments?

Can they integrate into existing navigation stacks?

Do they meet SWaP-C and sustainment requirements?

Can they be fielded at scale?

Companies that treat integration as a first class product requirement will move faster through the transition pipeline.

4. Early revenue comes from pilots not programs of record

In this market, early revenue comes from:

BAAs

OTAs

platform pilots

experimentation programs

Winning these is not a distraction from real revenue it is how real revenue is created. Every major defense sensor market followed this same pattern.

5. FY26 is the inflection point

The FY26 budget marks the point at which:

GNSS denial is no longer hypothetical

autonomy is no longer experimental

resilient navigation and sensing are no longer optional

Quantum sensing is being evaluated today not as a research curiosity, but as a solution to funded, operational problems.

Companies that engage now in the right programs, with the right buyers, and against the right missions will define who owns this market when it scales.